Oro Verde Limited (OVL)

Chuminga Progress & Update

21 August 2012 - Chairman: Dr Wolf Martinick

In this Open Briefing®, Chairman Dr Wolf Martinick discusses:

- Chuminga drilling results

- Vega project outlook

- New project potential

openbriefing.com

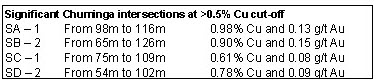

Oro Verde Ltd (ASX: OVL) has recently released drilling results from the first four exploration drill holes at Chuminga (OVL 20% interest with right to 100%) which was designed to test data previously recorded by Rio Tinto which indicated a 50 to 60 million tonne resource at 1.0 to 1.1% copper and 0.40 to 0.50 g/t gold. Sample results from the tests are shown below. Do the results so far meet your expectations and what is the current drilling schedule for Chuminga?

Chairman Wolf Martinick

We’re still evaluating the results of the initial drilling campaign; in the interim we’ve commenced a further stream sediment sampling program of the greater Chuminga area. When all of this data has been appraised a decision with respect to follow-up exploration will be made.

The results received to date are promising and confirm our expectations of the previously identified system, but with marginally lower copper grades than we’d expected. Ongoing assessment of the drilling results and the stream sediment program will allow us to build a better technical picture of the geological structure we’re dealing with and how best to explore it with further targeted drilling in the next phase of the program.

openbriefing.com

The company has the right to move to 100% ownership of Chuminga via payment of US$5 million in a combination of shares and cash (at the vendor’s election) within 18 months of acquiring the initial 20% interest. What results would be likely to trigger the company to move to 100% acquisition of Chuminga?

Chairman Wolf Martinick

The trigger will be results that confirm the presence of a large bulk tonnage and readily mineable ore body with good commercially attractive grades. That’s what this drilling and assessment program is designed to determine. At the moment we don’t have sufficient results to exercise this option and thus we’re likely to negotiate a possible option to extend our right. Our relationship with the vendor is very good and we’re confident we’ll be granted an extension if required.

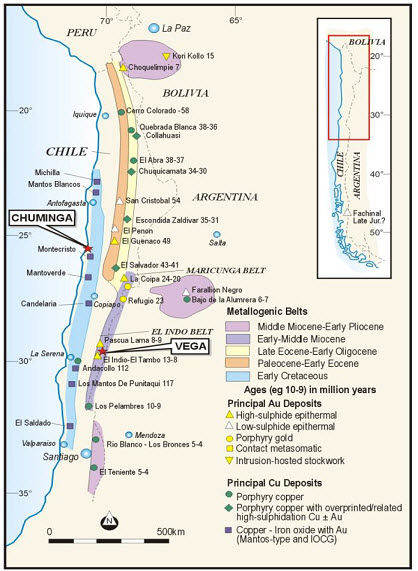

Prospect locations related to metallogenic belts

openbriefing.com

Results from early drilling at the Vega Project (OVL 100%) were disappointing, showing a weaker mineralised, older epithermal style system rather than the younger ‘El Indio’ porphyry style of mineralisation anticipated. You’ve indicated there is opportunity to re-enter the exploration holes to target a possible deeper porphyry. What is the likelihood that you will re-drill Vega and are there other targets on the 28 km² Vega tenements that are worth testing?

Chairman Wolf Martinick

Vega lies within the highly prolific Indio copper belt and our interest comprises 10 exploration concessions so there remains potential within this project area. We’re still appraising our options for Vega but it’s likely we’ll relinquish the tenements unless we can find a joint venture partner to develop them.

openbriefing.com

In the June quarterly report you indicate the company is considering other South American projects that have been brought to your attention. What are your guidelines for project investment and can you outline the projects you are considering?

Chairman Wolf Martinick

Chile and the area we’re currently focused on is highly prospective for copper and gold deposits but almost all of the country’s ground is in private hands so on any new potential exploration project we have to negotiate with a private company or family group. Numerous projects have been brought to our attention via our well established Chilean network and we’re constantly reviewing potential projects that fit within Oro Verde’s scope and strategy. Our focus remains on large tonnage, easy to mine, copper-gold projects in readily accessible regions. I’m optimistic we’ll acquire one or more such projects in the very near future but unfortunately, for commercial confidentiality reasons, I’m not in a position to give more details on the projects we’re currently investigating.

openbriefing.com

Cash at the end of the June quarter was $3.2 million. Is this sufficient for you to continue your planned drilling program and evaluation of new projects?

Chairman Wolf Martinick

We have a low cash burn rate and our drilling program is fully funded. We’re managing our cash very carefully to ensure it’s spent prudently and in the best interests of shareholders. In common with all exploration companies however, some time in the future we’ll need to raise more funding. But by the time that’s necessary I’m very confident it will be on the back of exciting exploration results that show there’s potential for a company-making project.

openbriefing.com

Thank you Wolf.

For more information on Oro Verde Limited, visit www.oroverde.com.au or call Chairman Dr Wolf Martinick on +61 417 942 466

DISCLAIMER: Orient Capital Pty Ltd has taken all reasonable care in publishing the information contained in this Open Briefing®; furthermore, the entirety of this Open Briefing® has been approved for release to the market by the participating company. It is information given in a summary form and does not purport to be complete. The information contained is not intended to be used as the basis for making any investment decision and you are solely responsible for any use you choose to make of the information. We strongly advise that you seek independent professional advice before making any investment decisions. Orient Capital Pty Ltd is not responsible for any consequences of the use you make of the information, including any loss or damage you or a third party might suffer as a result of that use.

The information in this report that relates to Exploration Results and Exploration Targets is based on information compiled by Brad Farrell, BSc Hons Eco Geol, MSc, PhD, a consultant to the Company. Dr Brad Farrell has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking. This qualifies Dr Farrell as a Competent Person as defined in the 2004 edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Dr Farrell consents to the inclusion in the report of the foregoing matters based on his information in the form and context in which it appears. Dr Farrell is a Fellow of the Australasian Institute of Mining & Metallurgy, a Chartered Professional Geologist of that body and a Member of the Mineral Industry Consultants Association (the Consultants Society of the Australasian Institute of Mining & Metallurgy

Latest Open Briefings

06 Dec 2011

Chairman on Next Steps

03 Nov 2011

AGM and Change of Activities

22 Aug 2011

Chairman on Company Direction