TNG Limited (TNG)

Managing Director on Mount Peake and Company Update

19 June 2012 - Managing Director: Paul Burton

In this Open Briefing®, MD Paul Burton discusses:

- Mount Peake Iron-Vanadium-Titanium Project

- TIVAN™ metallurgical process

- Extensive copper project portfolio

TNG Limited (ASX: TNG) is an exploration and development company with a multi-commodity resource portfolio in the Northern Territory and Western Australia. The company’s key project focus is the Mount Peake Iron-Vanadium-Titanium Project, located 235 kilometres north east of Alice Springs.

openbriefing.com

TNG has a range of projects but its key focus is the Mount Peake Iron-Vanadium-Titanium Project in the Northern Territory, 235km north east of Alice Springs. With a JORC Indicated Resource of 160 million tonnes grading 0.3% V205, 7% Ti02 and 27% Fe1, what are the advantages of a multi-commodity product like the type you plan to produce at Mount Peake?

MD Paul Burton

Our TIVAN™ metallurgical process allows the extraction of three key components; V205, (vanadium pentoxide), Ti02 (titanium dioxide) and Fe203 (iron oxide). The extraction of three commodities benefits us by allowing for three potential cash flow streams. Normally, extraction from this type of magnetite-gabbro deposit is either for the vanadium or the iron, and the titanium dioxide or vanadium is not recovered and would be seen as a waste by-product. Extracting three valuable products from this type of material underpins our project plans for Mount Peake.

openbriefing.com

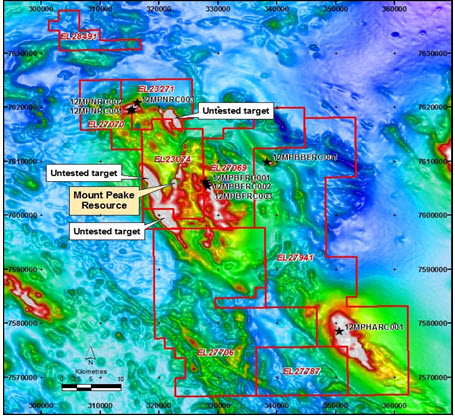

Further drilling by TNG on the Mount Peake 1601 million tonne resource commenced in April, targeting additional geophysical anomalies to assess the potential to expand the resource. What is the potential to increase the resource at Mount Peake and can you outline the current drilling schedule that will deliver that?

MD Paul Burton

Although we are confident that we have an approximate 20 year mine life at Mount Peake, we began drilling further regional targets with the intention of locating additional resource areas which could expand the total resource and potentially make the Mount Peake area a world class vanadium-titanium producing region.

The recent drilling results have confirmed the presence of substantial additional magnetite-gabbro, the host to the iron-vanadium-titanium mineralization, in the immediate region with grades consistent with the Mount Peake deposit. Further drilling is required for confirmation but these results are extremely positive. Together with Snowden Mining Consultants October 2011 resource model which showed that the deposit is still open to the east, the results encourage us that an exploration target of 500 -700Mt2 with a grade range of 0.2-0.4% V205, 23-25% Fe and 4-6& TiO2 is achievable2.

1 JORC Indicated and Inferred Resource of 160mt @0.3% V2O5, 5% TiO2 and 23% Fe (Indicated 110mt @0.29% V2O5, 5.3% TiO2 and 23% Fe; Inferred 48mt @ 0.24% V2O5, 4.5% TiO2 and 21% Fe).

2 The potential quantity and grade of the target is conceptual in nature as there has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in the determination of a mineral resource.

Mount Peake exploration targets

openbriefing.com

An interim 2011 Pre-Feasibility Study (PFS) showed that the Mount Peake Project would have a life of mine (LOM) of approximately 20 years, producing 2.5 million tpa, increasing to 5.0 million tpa in year four, for total metal production of 20.2 million tonnes Fe, 245,000 tonnes V205, and 6.5 million tonnes of Ti02. How will the successful adoption of the TIVAN™ process impact LOM and total metal production and will this be reflected in the PFS due in June 2012?

MD Paul Burton

The TIVAN™ process is critical to the economics of the Mount Peake Project and underpins our Pre-Feasibility Study. V205 is the most valuable product and currently sells for between $14,000 and $15,000 per tonne. The separation of the three key commodities we have achieved through the TIVAN™ process provides us with significant life of mine revenues over $10 billion (equivalent to a 3-4 million oz gold deposit). The current forecast LOM of 20 years is at a rate of 5 million tonne per annum. Given recent drilling results and knowledge that the deposit is still open to the east, we think the true mine life is in the region of 20 to 25 years. We intend to establish that with ongoing exploration.

openbriefing.com

At the end of the March quarter TNG had $5.0 million in cash, reflecting receipt in January of investment by Aosu Investment and Development Co Pty Ltd (Aosu) of $6.6 million. Receipt of the remaining $6.8 million from Ao-Zhong International Mineral Resources Pty Ltd, a subsidiary of the Jiangsu Eastern China Non-Ferrous Metals Investment Holding Co. Ltd (ECE) will bring the cash balance to over $11.0 million. How important is this investment for the development of the Mount Peake Project and the progress of the TIVAN™ process?

MD Paul Burton

TNG now has two key Chinese companies on its register which places us in a unique position. One of these is a private industrial company, Aosu, whose parent company in China, Suzhou Wanlong Electric Group Co. Ltd is a high-tech industrial electronics producer that uses titanium and vanadium and could be a potential purchaser of TNG’s end product.

ECE is a large state owned enterprise (SOE) with a good track record of exploration and mining. They own about 160 mines around the world and bring a wealth of experience to TNG. We now have their support and investment which takes our current cash position to around about $10.5 million. This provides a solid foundation to continue the assessment of Mount Peake through completion of the Pre-Feasibility Study, which following detailed review, could lead to a decision on progressing to a Definitive Feasibility Study. Additionally, it allows us to progress and complete the commercialisation of the TIVAN™ process.

openbriefing.com

Is there potential for off-take agreements with ECE which would assist TNG to secure the projected $476 million capex required for Mount Peake?

MD Paul Burton

There is strong potential for off-take agreements and one of the reasons we focused on a Chinese partner is because our end products are most likely to be utilised by Chinese companies. It was important for us to obtain a substantial Chinese partner that provides TNG with a two-way relationship; they could invest in us, while at the same time they could be our off-take partners or introduce off-take or financing partners or buyers of the end product. A successful outcome for the project would see a Chinese company completing the Engineering Procurements and Construction (EPC) in exchange for off-take. This would significantly reduce capex exposure which would then provide a very robust project, even with today’s commodity prices and exchange rates. This is our future plan at this stage.

openbriefing.com

What is the current supply demand situation for vanadium in global markets and where does TNG sit in terms of its production delivery timetable? Is there an advantage for Australian produced vanadium given our established steel making markets?

MD Paul Burton

Current demand for vanadium is mainly from China and this is principally supplied by Xstrata’s mines in South Africa, one or two mines in China and one or two mines in Russia. All these are small or sub-economic for a variety of reasons. Demand for vanadium has potential to double from current levels by 2015, outstripping forecast production. This is principally due to vanadium’s use as a strengthening agent in the process of making high-tech steel but there has also been a significant increase in demand for high-tech steels which use a combination of titanium and vanadium. These are used in medical products as well as high-tech aircraft and vehicle parts. Industrial and vehicle battery market growth is also a huge potential for the future demand for vanadium.

We estimate TNG will supply from Mount Peake, under 10% of the current demand for vanadium and we are confident we’ll be able to deliver and sell all our products. Our timetable remains unchanged and we expect to be in production by the end of 2014 or early 2015. An advantage of producing vanadium, iron and titanium from Mount Peake in the Northern Territory of Australia is ease of delivery to Asian steel mills, which are the largest consumers. We have a strong advantage being in the Northern Territory as we are close to the railway, and we can ship out of the Darwin Port, one of the busiest ports in the state and the closest to the Asian market.

openbriefing.com

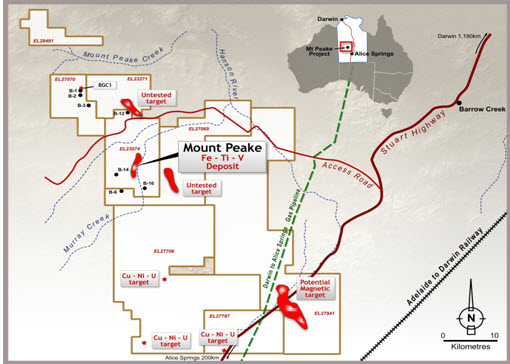

Mount Peake is located next to existing road, rail and gas infrastructure - this is a significant advantage over other remote projects. What other infrastructure and approvals are required?

MD Paul Burton

We wouldn’t have progressed Mount Peake without the existing infrastructure in place. The infrastructure provides a real economic advantage for the location of this project. Infrastructure for loading and taking the product to rail is still required and we are currently looking at approval for a road 50 to 80 kilometres to the rail. We are currently progressing negotiations with the traditional owners at Mount Peake for a Mining Agreement and the Environmental Impact Study (EIS) will be part of the final DFS.

The Northern Territory government has a Major Projects unit which is responsible for coordinating government involvement in major upcoming projects. TNG’s Mount Peake Project is listed as a major project and we have met with the Major Projects committee. The involvement of the Major Projects unit is an important factor for future approvals, including required government approvals. It acts as a link between us, the Department of Resources and the Minister. TNG has an excellent profile and reputation with the Northern Territory government and Department of Resources and we haven’t identified any issues that would prevent having future approvals passed.

Mount Peake Project location

openbriefing.com

TNG also has a number of base metal and copper gold projects in the pipeline and joint ventures such as an exploration agreement with Rio Tinto Exploration (RTX) for bauxite on TNG’s Melville Island tenements and a Heads Of Agreement (HOA) with Toro Energy (TOE) for all minerals except uranium at the Walabanba Hills Project. What are your priorities apart from the Mount Peake Project and how much funding will these projects be assigned?

TNG Projects

MD Paul Burton

In parallel to developing the Mount Peake Project, we are building a significant portfolio of copper projects within the Northern Territory. The Rio Tinto agreement for exploring for bauxite on Melville Island is a no-cost agreement for TNG and Rio Tinto must spend a minimum of $5 million to earn an 80% interest.

The HOA with Toro Energy relates to the Walabanba Hills Project which is located west of Mount Peake. It is part of what we call the Mount Peake regional area and is highly prospective for a range of minerals. As Toro Energy is solely a uranium explorer, they are happy for us to consider exploration over their area. The HOA requires TNG to initially spend $500,000 to earn a 51% interest in the Walabanba Hills Project. We are excited about exploration prospects as there are known copper, nickel and platinum group metals anomalies in that area and we are currently putting together a program to begin exploration.

openbriefing.com

TNG has recently announced the acquisition of further tenements within the Mount Hardy Copper Field region of Northern Territory. Why is this acquisition important to TNG’s strategy and what are the initial plans for this tenement?

MD Paul Burton

The Mount Hardy Copper Field is another important copper project area and we are currently progressing the final approvals for the transfer of the licence to TNG from Walla Mines Ltd. The Mount Hardy copper mines and prospects are within the Lander Group geological formation, the main geological formation for mineralisation around the Tanami region. The area has not undergone any modern exploration or deep drilling so we are confident it can potentially provide some very exciting discoveries for us.

The area has a number of known copper fields and anomalies on it, including some existing mines that were operated in the 1940s. We also have a range of rock chip samples collected by exploration companies, including Tanami Gold and Newmont Mining, during the 1990s. While their focus was on gold, rock chip sampling showed high percentages of copper, with some showing as high as 21%.

We are also excited by the presence of anomalous values for lead, zinc, gold and silver. These suggest the potential for more than solely a copper mineralised system. Along with the Walabanba Hills Project, we are putting together an exploration program for Mount Hardy involving detailed airborne electro-magnetic surveying. From these we expect to define drilling targets and be drilling in those areas in the second half of 2012.

openbriefing.com

What are TNG’s immediate priorities?

MD Paul Burton

The first milestone we are focusing on is completion of the Pre-Feasibility Study scheduled for the end of June. We are on track to achieve this and the consultants involved are METS, Snowden and SKM. After that, we would like to progress the TIVAN™ process through to commercialisation, and then decide on taking the project to DFS.

We intend to progress our copper projects as fast as possible but our focus remains on Mount Peake. Mount Peake’s strong production potential is the reason our Chinese partners have become involved and strongly support us. There is a lot of further exploration to be done at the Mount Peake Project over the next 6 months and as more results come in, we’ll create additional key milestones and targets for TNG to achieve. We are looking forward to a productive and exciting second half of the year.

openbriefing.com

Thank you Paul.

For more information about TNG Limited, visit www.tngltd.com.au or call Paul Burton on (+61 8) 9327 0900

DISCLAIMER: Orient Capital Pty Ltd has taken all reasonable care in publishing the information contained in this Open Briefing®; furthermore, the entirety of this Open Briefing® has been approved for release to the market by the participating company. It is information given in a summary form and does not purport to be complete. The information contained is not intended to be used as the basis for making any investment decision and you are solely responsible for any use you choose to make of the information. We strongly advise that you seek independent professional advice before making any investment decisions. Orient Capital Pty Ltd is not responsible for any consequences of the use you make of the information, including any loss or damage you or a third party might suffer as a result of that use.

Competent Person’s Statement

The information in this report that relates to Exploration Results and Exploration Targets is based on information compiled by Paul Burton who is a Member of The Australasian Institute of Mining and Metallurgy and a Director of TNG Limited. Paul Burton has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Paul Burton consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

The information in this report that relates to Mineral Resources is based on information compiled by Jeremy Peters who is a Member of The Australasian Institute of Mining and Metallurgy and a full time employee of Snowden Mining Industry Consultants Pty Ltd. Jeremy Peters has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Jeremy Peters consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

Forward-Looking Statements

This report contains ‘forward-looking information’ that is based on the Company’s expectations, estimates and projections as of the date on which the statements were made. This forward-looking information includes, among other things, statements with respect to the Company’s business strategy, plans, objectives, performance, outlook, growth, cash flow, earnings per share and shareholder value, projections, targets and expectations, mineral reserves and resources, results of exploration and related expenses, property acquisitions, mine development, mine operations, drilling activity, sampling and other data, grade and recovery levels, future production, capital costs, expenditures for environmental matters, life of mine, completion dates, and currency exchange rates. Generally, this forward-looking infor-mation can be identified by the use of forward-looking terminology such as ‘outlook’, ‘anticipate’, ‘project’, ‘target’, ‘likely’, ‘believe’, ‘estimate’, ‘expect’, ‘intend’, ‘may’, ‘would’, ‘could’, ‘should’, ‘scheduled’, ‘will’, ‘plan’, ‘forecast’ and similar expressions. Persons reading this report are cautioned that such statements are only predictions, and that the

Company’s actual future results or performance may be materially different.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. Forward-looking information is developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to the risk factors set out in the Company’s Annual Information Form.

This list is not exhaustive of the factors that may affect our forward-looking information. These and other factors should be considered care-fully and readers should not place undue reliance on such forward-looking information. The Company disclaims any intent or obligations to update or revise any forward-looking statements whether as a result of new information, estimates or options, future events or results or otherwise, unless required to do so by law.